Transitioning from “pitching a vision” to “reporting on reality” is a significant shift for a Founder. Initially, the board report may seem like a burdensome administrative task or a distraction from the “real work” of building. However, viewed through a strategic lens, the board report is actually a powerful communication device. It is a tool for engaging investors and advisors to become active, aligned partners who can offer high-level guidance, unlock networks, and provide the experience necessary for growth.

In our work at Attivo, we support founders across a wide range of venture-backed companies. We’ve seen that the purpose of board reporting doesn’t actually change much by company size or stage. What changes is how intentionally it’s used to clarify priorities and create productive discussion.

At its best, board reporting isn’t about formality or compliance. It’s about creating the conditions for clearer thinking, better alignment, and stronger decisions.

The Role of the Board Meeting

When it’s working well, a board meeting creates shared understanding around where the business stands, where uncertainty remains, and what decisions matter most in the period ahead. Board members have often seen similar moments play out across dozens of companies and can help teams understand where they are relative to expectations and constraints.

The quality of that discussion depends less on the volume of information and more on how intentionally it’s structured. When board reporting is treated as a quick status update, conversations tend to stay tactical. When it’s approached as a leadership exercise, the board has more room to function as a strategic partner.

How This Changes by Stage

What’s reported naturally evolves as a company matures, but the role of board reporting itself remains consistent: helping leadership and investors stay aligned around what matters most.

Pre–market fit

At this stage, board discussions tend to center on progress toward validation rather than detailed financial results. Product development milestones, signals from early users, and learning velocity typically matter more than precision reporting. Financials are kept high-level, supporting a single question: Is the company moving closer to market fit?

Post–market fit

As traction begins to take shape, the focus shifts. Pricing, repeatability, and early go-to-market execution come into clearer view, alongside questions of scalability. Budgets and forecasts start to play a more active role—not as rigid constraints, but as tools for testing assumptions and planning next steps.

Scaling

As companies grow, reporting becomes more comprehensive. Board conversations often move toward capital allocation, operating efficiency, and the pace of expansion. Financial detail increases, but continues to serve the same objective: enabling informed, forward-looking decisions.

The underlying structure stays consistent, while the specific metrics evolve with the business.

A Simple, Durable Framework

Across stages and industries, effective board reporting tends to follow a similar structure—not because there’s a universal template, but because certain elements consistently support better conversations. The most successful structures focus on surfacing challenges early, allowing founders to mobilize their board’s support. When done right, reporting becomes a two-way street that ensures your investors are providing the actual support and problem-solving you need to move forward.

1. Executive summary

A concise, CEO-level framing of what changed over the period, what matters most right now, and why.

2. Progress against priorities

A return to the few things the company said it would focus on. What moved forward? What didn’t? And what was learned along the way?

3. Functional updates (as needed)

Product, go-to-market, hiring, or operations—shared where they directly support the strategic narrative, rather than as standalone status updates.

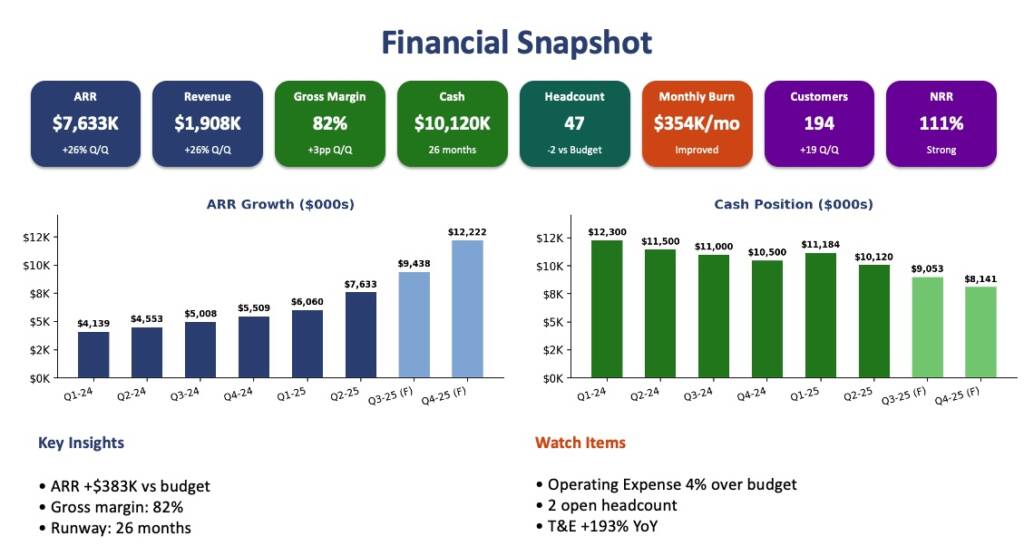

4. Financial snapshot

A focused view of the numbers that matter at the company’s current stage. Cash burn, runway, and performance against plan are often enough. The goal is clarity, not volume.

5. Discussion and asks

Time reserved for questions, perspective, and decision-making. This tends to work best when materials are shared in advance, giving board members time to reflect and engage more productively in the discussion.

The structure is simple by design. In board reporting, focus tends to produce more insight than complexity. By stripping away the non-essential, you focus the board’s collective intelligence onto the decisions where their experience matters.

Financial Snapshot

The financial section of the board deck differs across funding and product fit / revenue stage. Typically, the board wants to see eight quarters of financial data. At the scaling stage, the company should include actual performance versus forecast. Here’s the suggested data that should be shared by stage:

The Board Deck as a Thinking Tool

The board deck serves a practical role beyond investor communication. It creates a regular moment for leadership to step back from execution and assess the business more holistically.

Prepared well, it helps to organize a small set of questions that matter most in a given period: what actually changed, where assumptions held or broke, and which decisions are now in front of the company. That framing provides direction for board discussions, rather than treating the meeting as a retrospective.

Over time, teams that approach board reporting this way tend to use their board meetings more effectively. Conversations are more focused, trade-offs are clearer, and decision-making is more informed.

Need support preparing for your next board meeting?

Attivo provides fractional CFO support to venture-backed companies, helping founders prepare decision-ready board materials and make better use of board time—drawing on perspective gained from working across many boardrooms and stages of growth. Get in touch at info@attivopartners to learn more.